"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Multifamily Insurance Claim Public Adjusters

Get Fair, Fast, and Fully Documented Settlements for Apartments, Condos, Townhomes & HOAs

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Get Fair, Fast, and Fully Documented Settlements for Apartments, Condos, Townhomes & HOAs

Multifamily Insurance Claim Public Adjusters

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

Specialized Claim Help for Multifamily Properties

When a fire, hailstorm, tornado, hurricane, pipe burst, or other disaster hits a multifamily community, the stakes are high. Multiple buildings, hundreds of units, loss of rental income, and complex commercial policy language can turn a claim into a full-time job. We represent policyholders only—never insurance companies—to prepare, present, and negotiate your large-loss multifamily property damage claim so you can recover promptly and completely.

When a fire, hailstorm, tornado, hurricane, pipe burst, or other disaster hits a multifamily community, the stakes are high. Multiple buildings, hundreds of units, loss of rental income, and complex commercial policy language can turn a claim into a full-time job. We represent policyholders only—never insurance companies—to prepare, present, and negotiate your large-loss multifamily property damage claim so you can recover promptly and completely.

Why owners & operators choose us

20+

Years handling large-loss commercial & multifamily claims

500+

complex property claims resolved

90%

settled without unnecessary litigation or appraisal

Contingency for claims

>$250,000

after deductible (no recovery, no fee)

Apartment & Multifamily Damage Claim Experts

Damage Claim Results For Policyholders

ICRS Advocates For Policyholders

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We maximize settlements without unnecessary legal battles.

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

Why You Need a Multifamily Specialist (Not a Generalist)

Multifamily claims are not just “big residential” or “typical commercial.” They involve intertwined building systems, multiple insured locations, residential habitability, and income continuity. We navigate the details that routinely drive value:

Roofing systems: TPO/PVC/EPDM assemblies, hail impact to membranes/insulation, uplift testing, manufacturer requirements, brittle testing, code-mandated replacement vs spot repairs.

Building envelope: EIFS/stucco moisture intrusion, brick veneer ties, window/door assemblies, balcony waterproofing.

MEP systems: Chillers, boilers, cooling towers, split systems, electrical risers/panels, life-safety systems.

Interior scope: Unit-by-unit matrixing, finishes tiers, as-built variances, moisture mapping, contents and fixture responsibilities (condo vs HOA/COA).

Financial modeling: Rent rolls, concessions, vacancy trends, seasonal occupancy, make-ready timelines, and market conditions for period of restoration calculations.

Coverage pitfalls: Blanket vs scheduled limits, coinsurance, deductibles (including percentage and Named Storm), sublimits, waiting periods, and deductibles stacking across buildings.

Your Rights, the Insurer’s Duties, and the Principle of Indemnity

Insurance is designed to indemnify you—i.e., to restore your property and operations to the financial condition that existed immediately before the loss (no better, no worse). In practice, that means:

Replacement Cost (RCV) vs. Actual Cash Value (ACV): understand depreciation holdback and what documentation is required to release it.

Ordinance or Law: code upgrades are often additional to base repairs. We document applicability and quantify costs.

Business Interruption: the carrier must evaluate lost rental income and Extra Expense incurred to reduce the loss (e.g., temporary cooling or relocation).

Good-Faith Claims Handling: insurers owe policyholders an obligation of utmost good faith and fair dealing. Evidence supporting coverage must be given equal consideration to any evidence the insurer believes may limit or exclude coverage. Our submissions are built to make that duty unavoidable.

Important: Bad-faith and prompt-payment standards vary by state. Many jurisdictions impose penalties or interest for unreasonably delayed or underpaid claims. We’ll explain your options and timelines based on your property’s location and policy.

Common Carrier Pushbacks—And How We Counter Them

“Cosmetic only” hail on membranes → we provide uplift/insulation moisture data, manufacturer requirements, and code triggers.

“Wear & tear” vs. storm → meteorological correlation, brittle tests, and excluded vs. ensuing damage analysis.

Under-scoped interiors → unit matrices, finish tiers, productivity factors, and phasing constraints in occupied communities.

BI minimized → rent roll analytics, reasonable period of restoration, and quantifying Extra Expense to maintain occupancy.

The Multifamily Claims Process:

What “Good” Looks Like

Triage & Stabilize

Mitigation vendor selection, emergency services oversight, habitability and safety, temporary measures that also preserve evidence.

Coverage & Strategy Review

Policy language mapping (insuring agreement, exclusions, endorsements), deductibles, sublimits, waiting periods, BI triggers, ordinance/code.

Forensics & Causation

Independent experts (roof, envelope, MEP, fire origin/cause, meteorology) to establish covered causation and separate pre-existing conditions.

Scope, Quantification & Pricing

Room-by-room, unit-by-unit matrices; detailed assemblies; code requirements; Xactimate/RSMeans line items; contractor bids; photos & diagrams.

Business Interruption (Loss of Rents)

Baseline revenue, trend adjustments, seasonal factors, occupancy and lease-up, concessions, downtime scheduling, critical path logic, Extra Expense offsets.

Formal Claim Presentation

Proof of Loss (where required), indexed exhibits, expert reports, estimate reconciliations, depreciation logic, and clear asks tied to the policy.

Negotiation & Resolution

Carrier field/desk alignment, joint inspections, appraisal/mediation strategies only when value-add, release of holdbacks, supplemental submissions.

What Policyholders Should Do Now (Pro Tips)

Document immediately: photos/video by elevation and unit; inventory damaged elements; save all invoices and time logs.

Control mitigation: choose qualified vendors; preserve samples; do not authorize “like kind and quality” shortcuts that conflict with code/manufacturer specs.

Centralize communications: keep an email trail; log calls; request adjuster positions in writing.

Mind deadlines: Proof of Loss dates, suit limitations, BI waiting periods, depreciation release windows.

Ask for equal consideration: request the insurer identify all evidence considered both for and against coverage—this frames the duty of good faith.

Bring in a specialist early: the best results start with the first notice, not the first dispute.

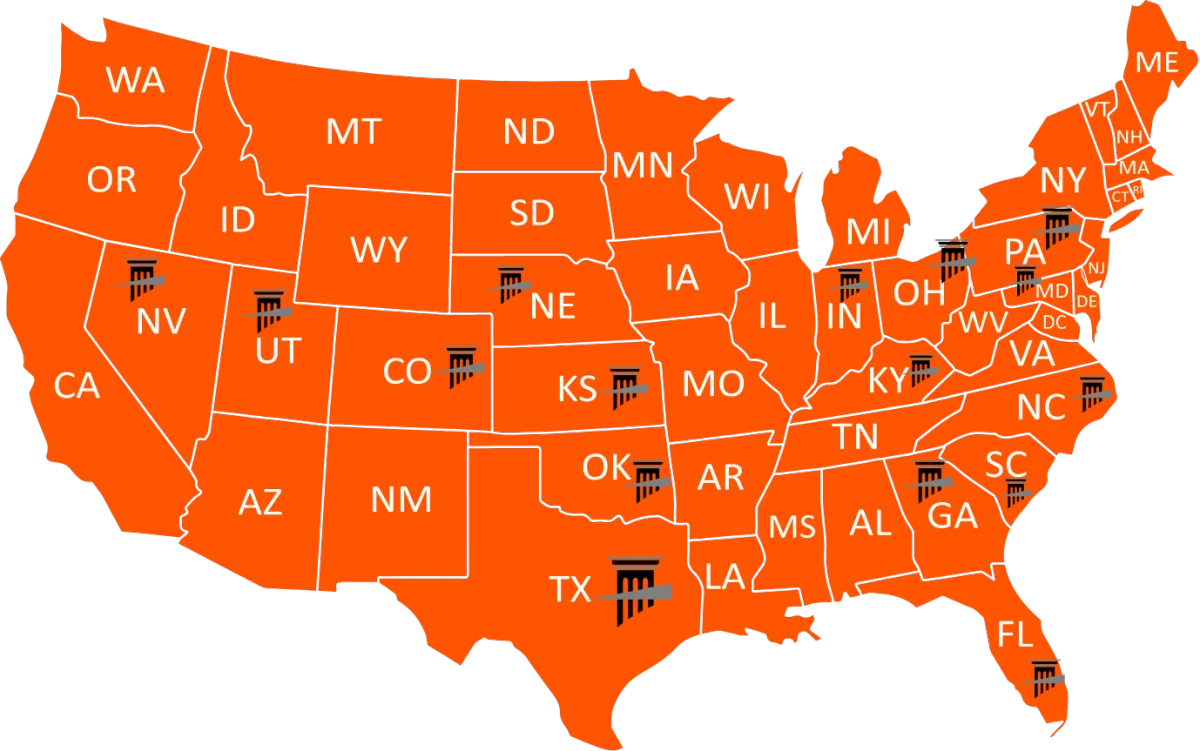

Service Area & Licensing

We are licensed public insurance adjusters. At this time:

Licensed States:

Texas, Colorado, Florida, Georgia, Indiana, Kansas, Kentucky, Maryland, Nebraska, Nevada, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, Utah.

If your property is outside our licensed jurisdictions, we can often coordinate with trusted, licensed partners. Ask us about options for your location.

Pricing & Engagement

ICRS Contingency (for losses >$250,000 after deductible): We are paid a percentage of the claim only if you recover.

Educational Resource: Insurance Claim Bible

Who We Help

Apartment building owners & operators

Multifamily portfolios and REITs

Condominium associations (COAs)

Townhome communities

Homeowner associations (HOAs)

3rd party managers & asset/property management companies

Developers and receiverships

Struggling With?

Initial Damage Claims

Whether you're filing an insurance claim for an apartment building or multifamily complex filing it correctly from the outset is crucial.

Large-loss damage claims involve significant property damage and high-dollar settlements. As one of the Nation's most trusted public adjusters, we make sure your initial claim is accurately documented, aggressively represented, and positioned for maximum settlement in minimum time.

Underpaid Damage Claims

Insurance companies often lowball damage claim payouts especially on large-loss properties. If your settlement doesn’t match the real scope of damage, you could be leaving thousands on the table.

At ICRS our experts identify missed damage, undervalued estimates, and hidden policy coverage gaps. We reopen, negotiate, and supplement

underpaid claims to recover what you’re truly owed.

Delayed or Denied Damage Claims

Denied damage claim? You’re not alone. Insurers often cite

policy exclusions, pre-existing damage, or missing documentation

to avoid paying.

Our public adjusters specialize in

overturning wrongfully denied damage claims - correcting inspection errors, providing new documentation, and demanding fair treatment.

Perils & Loss Types We Handle

Property damage

Fire/smoke, hail, wind/tornado, hurricane, water & freeze, collapse, vandalism

Complex coverages

Ordinance or law/code upgrades, flood (where applicable), equipment/mechanical failures

Financial loss

Business Interruption / Loss of Rents, Extra Expense, Soft Costs, Debris Removal

Get Your Claim Review

MultifamilyClaim.com is built for owners, associations, and managers who need experienced advocates to maximize recovery and minimize downtime

Free large-loss claim review (>$250K after deductible)

Rapid onboarding, clear milestones, and transparent communication

Let’s talk about your property and your recovery timeline—today.

On Equal Consideration & Utmost Good Faith—What It Means for You

Your insurer must fairly investigate your loss and give equal weight to evidence that supports coverage as to evidence it believes limits coverage. We design claim files that make fair consideration inescapable: clear causation, code triggers, quantified scope, credible BI calculations, and airtight documentation—so your path to indemnity is clear.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Licensed Public Adjusters In 16 States:

Get Your Claim Review

MultifamilyClaim.com is built for owners, associations, and managers who need experienced advocates to maximize recovery and minimize downtime

Free large-loss claim review (>$250K after deductible)

Rapid onboarding, clear milestones, and transparent communication

Storm and wind damage

Let’s talk about your property and your recovery timeline—today.

On Equal Consideration & Utmost Good Faith—What It Means for You

Your insurer must fairly investigate your loss and give equal weight to evidence that supports coverage as to evidence it believes limits coverage. We design claim files that make fair consideration inescapable: clear causation, code triggers, quantified scope, credible BI calculations, and airtight documentation—so your path to indemnity is clear.

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Unsure If you need a public adjuster?

Frequently Asked Questions

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

What does a public adjuster do for multifamily property insurance claims?

A licensed public adjuster represents the policyholder—not the insurance company—to prepare, present, and negotiate your claim for maximum recovery. For large multifamily losses, a public adjuster documents the full scope of property and business interruption damages, ensuring nothing is left unpaid or undervalued.

What types of property damage are covered in a multifamily insurance claim?

Most commercial and multifamily insurance policies cover fire, hail, wind, tornado, hurricane, water, freeze, and vandalism damage. Specialized coverage often includes Ordinance or Law upgrades, Business Interruption (Loss of Rents), and Extra Expense.

How does a public adjuster help HOAs and condominium associations?

For HOAs and COAs, public adjusters handle large-scale claims involving common areas, building envelopes, clubhouses, roofs, and shared mechanical systems. They coordinate with the board, property manager, and insurer to recover funds for both structure and loss-of-use damages.

Why should apartment or condo owners hire a public adjuster after a storm or fire?

Public adjusters who specialize in multifamily property damage understand the complexities of roofs, HVAC systems, and shared structures. They make sure your insurer honors policy terms, code upgrades, and loss of rent coverage—so you can focus on rebuilding, not red tape.

How long does a multifamily property claim take to settle?

Large-loss claims can take several months, depending on carrier responsiveness, documentation complexity, and scope. With a public adjuster, timelines are typically shorter due to proactive documentation, negotiation, and follow-through.

When should we bring you in?

Immediately after loss. Early involvement preserves evidence, sets coverage strategy, and prevents costly missteps.

Do I have to use the carrier’s preferred contractor or consultant?

No. You control vendor selection. We help you align scopes with code/manufacturer requirements and protect warranties.

Are public adjuster fees worth it for large claims?

Yes. For claims exceeding $250,000 after deductible, a contingency-based public adjuster often recovers significantly more than the insurer’s initial offer—typically offsetting their fee many times over.

Will filing hurt my renewals?

Insurers underwrite frequency/severity, but properly documented, covered losses are what you pay premiums for. Poorly handled claims often cost more at renewal.

What is “period of restoration” for BI/Loss of Rents?

The reasonable time to restore operations to pre-loss levels—based on scope, permitting, material lead times, and market constraints. We document a defensible schedule.

What if the insurer delays or lowballs?

States typically require timely, good-faith handling. Where appropriate, we escalate, supplement the record, and pursue appraisal/mediation or other remedies available under your policy and state law.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2025. ICRS LLC. All Rights Reserved.